In a recent interview on CNBC website host information

In a recent interview on CNBC website host information

Real Estate: This Spring Will Be Different

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

MILLENNIALS

Contrary to many reports, this age demographic is READY, WILLING and ABLE to become homeowners. As a matter of fact, the latest National Association of Realtors’ gender study revealed that the Millennial generation has recently accounted for a greater percentage of all buyers than any other generation.

BABY BOOMERS

As prices have risen, so has the equity in many homes across American. Homeowners, having been shackled to their house because of low or negative equity for the last several years, are again free to make a move without worrying about bringing cash to a closing table in order to sell. We believe this new-found freedom will release a pent-up demand of sellers who want to move-up to the home they’ve always dreamed of or want to downsize their primary residence and also purchase a second home they can use for vacation, retirement or both.

BOTH PRICES and MORTGAGE RATES are on the RISE

As the economy improves, more and more Americans are regaining faith that their own personal finances are headed in a positive direction. With this new confidence, they want to take advantage of the opportunity that presents itself with real estate still undervalued in most parts of the country and mortgage rates being well below historic numbers.

If you are a professional in the industry and want to learn how to leverage this opportunity and optimize your business during this spring’s real estate market, please join us today at 2PM (EST) on our FREE webinar, Spring Ahead in 2014: KCM’s Action Plan for Dominating this Buyers’ Season.

Real Estate: We are NOT the Only Ones Saying You Should Buy

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

Benefits of Owning

Joint Center for Housing Studies, Harvard University

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord…Having to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings.”

“Renters have much lower median and mean net worth than homeowners in any survey year.”

Benefits of Buying Now

“Buying costs less than renting in all 100 large U.S. metros… Now, at a 30-year fixed rate of 4.5%, buying is 38% cheaper than renting nationally.”

“One thing seems certain: we are not likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012…Yes, rates are higher than they were a year ago – and certainly higher than two years ago. But if you look at the averages over the last four decades, today’s rates remain historically low.”

True real estate professionals have information like this at their fingertips. If you want to be seen as the go-to agent in your marketplace, watch a free replay of our recent webinar, Becoming the Industry Expert in Your Market.

ip address . what is my whois domain owner into eminent domain

Thinking of Buying a Vacation/Retirement Home? Why Wait?

The sales of vacation homes skyrocketed last year. A recent study also revealed that 25% of those surveyed said they’d likely buy a second home, such as a vacation or beach house, to use during retirement. For many Baby Boomers, the idea of finally purchasing that vacation home (that they may eventually use in retirement) makes more and more sense as the economy improves and the housing market recovers.

The sales of vacation homes skyrocketed last year. A recent study also revealed that 25% of those surveyed said they’d likely buy a second home, such as a vacation or beach house, to use during retirement. For many Baby Boomers, the idea of finally purchasing that vacation home (that they may eventually use in retirement) makes more and more sense as the economy improves and the housing market recovers.

If your family is thinking about purchasing that second home, now may be the perfect time. Prices are still great. dont ask dont tell If you decide to lease the property until you’re ready to occupy it full time, the rental market in most areas is very strong. And you can still get a great mortgage interest rate.

But current mortgage rates won’t last forever…

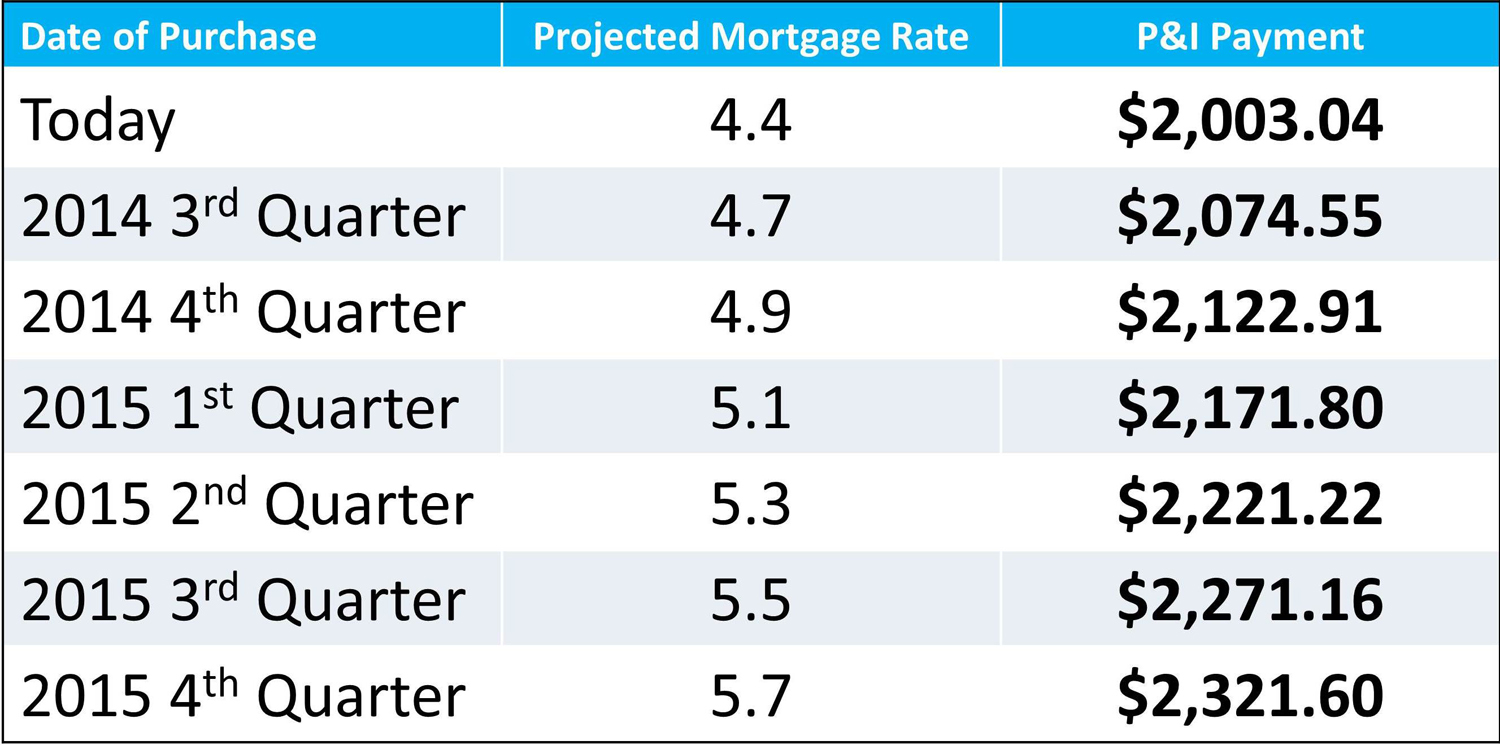

According to FreddieMac, the interest rate for a 30 year fixed rate mortgage at the beginning of April was 4.4%. However, FreddieMac predicts that mortgage rates will steadily climb over the next six quarters.

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

If you are a real estate professional and want a deeper understanding of how market conditions will impact buyers this spring, please join us Thursday at 2PM ET for a free webinar entitled: Spring Ahead in 2014: KCM’s Action Plan for Dominating the Spring Buyers’ Season.

Want to Sell Your House? Price it Right!

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase.

Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter.

Bottom Line

Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.

Let’s Help Millennials Make the Best Decision

We strongly believe that this is the year Millennials will re-enter the housing market in a VERY BIG WAY. NAR’s recent Home Buyer and Seller Generational Trends report has revealed that this generation already makes up a higher percentage of home purchasers than any other generation. The reason is that Millennials associate homeownership with these all important attributes: With 49% […]

function checkminilogin_1085Form() { if(document.minilogin_1085.mini_user_login_1085.value==” || document.minilogin_1085.mini_user_pass_1085.value==”){ alert(‘Please enter your email and password to login.’); return false; }}

Modern Democracy – The challenge for freedom in most countries

Modern Democracy – The challenge for freedom in most countries

The battle for self-sufficiency in all of the nations held extreme effects relating to the dwells of countless patriots that believed they deserved liberty from oppression and political injustices. (more…)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link